Gill Capital Partners January 2026 Market Update

2026 is here, and it picked up where 2025 left off, with a mix of chaotic macro headlines and head-scratching geopolitical events. It appears that 2026 is setting up to be another volatile year, so buckle up. We will jump right in and review fundamentals, examine recent developments at the Federal Reserve to glean clues about where interest rates may be headed in the near term, and take a look at why the U.S. Dollar is in a free fall. Before we get into all of that, however, we want to honor the life of one of the greatest musicians in music history: Bob Weir of the Grateful Dead.

Long-time clients of Gill Capital Partners know that we are huge music fans, and Bob Weir was a legend who recently passed away at 78. Bob will be remembered for his unique playing style and distinct voice, having played an estimated and unbelievable 5,000 live shows. Bob, as one of the final original Grateful Dead members, leaves a nearly unmatched musical legacy. Fare thee well, Bob!

Update on Economic Fundamentals

Turning to the economy, updated economic reports have been released. Below are recent data points on jobs, consumer spending, inflation, the Federal Reserve, and the U.S. Dollar, along with our views on these fundamentals. As a reminder, we focus on fundamentals over headlines, so let's have a look.

Jobs & Consumer Spending – Below is a summary of the latest data on the U.S. labor market. As always, we like to look at several sources to provide a comprehensive picture of what is happening in the labor market and what this may mean for the consumer, including reports from ADP, Challenger, Gray & Christmas, and the monthly BLS jobs report (which covers broad employment data, including government employment).

The Bureau of Labor Statistics (BLS) recently released the December jobs report. Total non-farm payroll employment increased modestly by 50,000 jobs and the unemployment rate held steady at 4.4%. Annual payroll growth for 2025 averaged approximately 49,000 jobs per month, significantly lower than the 168,000 monthly average in 2024.

The ADP National Employment Report is a monthly look at private sector employment. In their most recent report from December, employers reported that hiring increased by 41,000 jobs in October. This number was modestly better than consensus estimates, which expected job growth to be near 25,000 for the month. Private sector jobs have also seen a meaningful slowdown from the pace of the last couple of years.

The Layoff Tracker is a monthly report by Challenger, Gray & Christmas, an executive outplacement and career transition firm, that compiles the number of job cuts announced by U.S.-based employers and has been published monthly since the 1990s. The most recent data shows the U.S.-based employers announced 35,553 job cuts in December, the lowest total for the year. In total, employers announced 1,206,374 job cuts in calendar year 2025, marking a 58% increase over 2024 and the highest level since 2020.

The most recent official retail sales data from the U.S. Census Bureau is still delayed. November 2025 data showed that retail and food services sales rose 0.6% month-over-month and were up 3.3% year-over-year, indicating resilient consumer spending late in the year. Preliminary high-frequency estimates for December 2025 suggest that retail and food services sales expanded further by roughly 0.4% in December, with year-over-year gains near 3.9%, signaling continued consumer activity through year-end before seasonal adjustments.

Our view

The data points referenced above point to a weak labor market as we continue to hear about more AI-related layoff announcements. This dynamic is good for corporations and earnings, but bad for the labor market as a whole. The unemployment rate is currently at 4.5% and rising, a number that is still below the long-term average of just under 6%. So, while the market continues to weaken, it remains, from a nominal and historical perspective, in an okay spot. This, combined with investors’ perception that their wealth has increased over the past three years (the “wealth effect”), has created an environment in which the American consumer continues to spend and appears comfortable ignoring macro headlines.

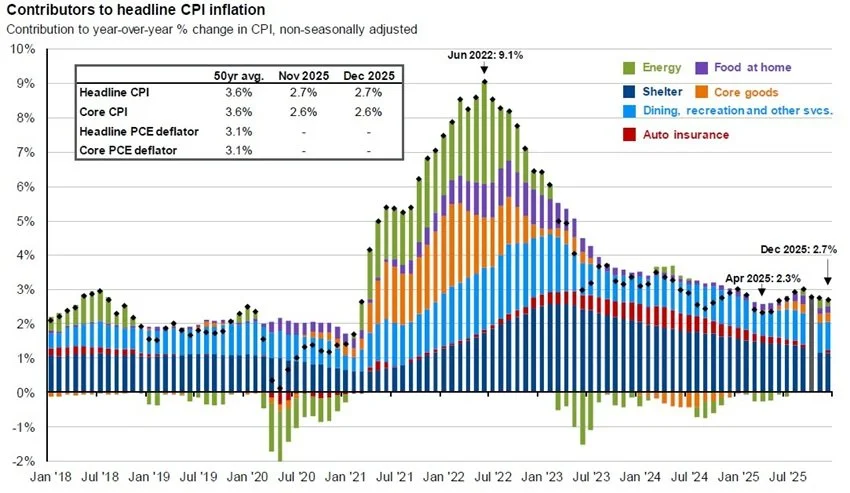

Inflation – The most recent Consumer Price Index (CPI) report, released by the Bureau of Labor Statistics, shows that prices continued to rise in December 2025. Headline CPI increased 0.3% month-over-month (seasonally adjusted) in December, and rose 2.7% on a year-over-year basis, down modestly from prior months but still above the Federal Reserve’s 2.0% target and slightly above analyst expectations. Core CPI, which excludes volatile food and energy prices, also rose 0.2% for the month and 2.6% over the past 12 months. Shelter and food costs were among the largest contributors to monthly inflation, along with rising energy prices. Although inflation has eased significantly from its multi-year highs in 2022 and early 2023, the year-end data indicate that price pressures remain persistent and above target heading into early 2026.

Our view – Inflation remains above key Federal Reserve targets and is expected to remain elevated due to the impact of tariffs, along with a weakening U.S. Dollar. We are seeing significant erosion of the U.S. dollar (more on this below), which is currently at its weakest point since the middle of 2021 against most foreign currencies. Inflation isn’t always as simple as prices rising; it can be driven by currency devaluation or a combination of the two, which we are experiencing today. This type of environment is driving asset inflation across a multitude of assets, including equities (particularly international equities), commodities, and other hard assets. This inflationary environment, much of which is policy-induced, is continuing to put the Federal Reserve in an extremely difficult spot as it attempts to balance its dual mandates amid a softening labor market, and there is probably no more insidious tax on the general population than inflation.

Interest Rates & The Federal Reserve - At its January meeting, which took place this week, the Federal Reserve held its benchmark interest rate steady at a target range of 3.5% to 3.75%, pausing after three consecutive rate cuts in 2025. The 10-2 decision in favor of the pause was not unanimous: two members, Stephen Miran and Christopher Waller, again dissented, preferring a 25-basis-point cut. Officials signaled they wanted more time to assess incoming economic data, given that inflation remains above the Fed’s 2% target and the labor market is showing signs of slowing.

Markets had widely expected a pause at this meeting and have been recalibrating rate-cut odds amid persistent inflation and mixed labor data. Interest rate markets are pricing in one additional cut in 2026.

Our view - As stated above, this was widely anticipated, so there were no major surprises here. We continue to believe that the Fed is currently in a very difficult position trying to serve its dual mandates (maintaining stable prices and achieving full employment) in this environment. A pause here is profoundly logical, allowing the economy to digest recent rate cuts while providing time to assess the impacts of other exogenous forces and policies. It can take a year or more for the economy to fully incorporate changes to monetary policy. The Fed has to take inflation seriously, and this suggests they will.

U.S. Dollar Weakness – The U.S. dollar, as measured against a trade-weighted basket of global currencies, was down 9.5% in 2025 and, as of this writing, is down another 2.5% in 2026, pushing it to its lowest levels since 2021. This has been driven by a multitude of factors, including interest rate differentials, trade balances, concerns about U.S. fiscal discipline, and lack of independence at the Federal Reserve. The Dollar saw its largest single-day drop this week following comments by President Trump that the market interpreted as support for a weaker U.S. Dollar.

Our view – The long-term U.S. Dollar bull market that has been in place since the Great Financial Crisis in 2008 appears to have ended last year, and the dynamics in place today likely support continued weakness. A weaker currency does not necessarily signal bad things to come; it can offer some advantages, but it also informs our investment outlook going forward. In periods of a weakening U.S. Dollar, for example, we would look for international assets to outperform domestic assets, and the demand for exports can increase due to lower costs for foreign buyers, potentially stimulating the economy. Conversely, imported goods, international travel, and the cost of many goods may feel more expensive. A weaker Dollar could also limit how much U.S. interest rates fall. Foreign investors may be less willing to buy U.S. Treasuries than in the past, which could limit the decline in yields. We will keep you updated on further currency developments as they unfold.

As always, please let us know if you have any questions or concerns, or if we can provide assistance with any other financial planning matters, including education, taxes, insurance, or estate needs.