Gill Capital Partners August 2025 Market Update

From the team at Gill Capital Partners, we hope you are enjoying your summer! We want to provide you with an update on the economy and markets; however, if you are playing on a beautiful beach, exploring a new city, or just enjoying your back patio and don’t want to think about the news, please feel free to disregard this, and we’ll catch up when you are back. This month, we have a few updates on economic fundamentals including jobs and consumer data, inflation, interest rates, and why the Federal Reserve is in a “pickle.” We will provide an update on the stock market and, of course, provide our views. We will also be sending out a separate piece shortly with a summary of the new tax legislation that was recently passed in Washington, so be on the lookout for that. Before we jump in, here’s the interesting data point of the month.

U.S. electrical demand hits an all-time high.

As shown in the chart below, U.S. electrical demand has been flat for the past 15 years, having peaked in 2007. U.S. electrical demands are growing again, largely due to technological companies building data and computing capabilities that require enormous amounts of energy. With energy demand increasing, don’t sleep on grandma's utility stocks; they are the number one performing sector in the U.S. market this year, up 16%+.

Update on Economic Fundamentals

As always, we like to focus on the fundamentals rather than the headlines. We have received quite a few intriguing data points over the past month.

Jobs & Consumer Spending – Jobs reporting data roared into the headlines over the past week. President Trump was not happy with softening data in the jobs report, which led to the firing of the Bureau of Labor Statistics (BLS) Commissioner. We look at multiple sources of jobs data to try to get a comprehensive picture of what is happening in the labor market and what that might mean for the consumer.

There have been several updates on the labor market, including reports from ADP, Challenger, Gray & Christmas, and the monthly BLS jobs report, which covers the broader labor market, including government employment.

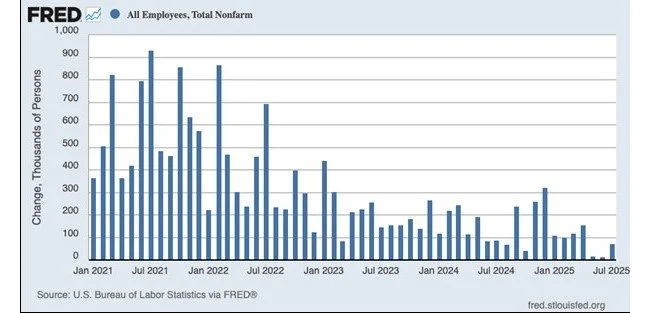

The most recent monthly jobs report, as released by the BLS, showed that the U.S. economy added only 73,000 jobs, well below the consensus estimate of over 100,000 jobs. Additionally, the prior month revisions for May and June revised job growth lower by approximately 258,000 jobs, severely altering the picture of the labor market. The unemployment rate rose to 4.2%. These monthly numbers are always subject to revisions due to the timing of reporting coming in from both private and public employers, and it is common to see significant revisions to monthly data.

ADP National Employment Report—The ADP report is a monthly look at private sector employment. For the month of July, private employers added 104,000 jobs, which was in line with estimates. This follows a very weak June report that unexpectedly showed net losses of 33,000 jobs, marking the first monthly drop in more than two years and a significant miss compared to the expectation of 100,000 jobs gained.

Challenger, Gray & Christmas Layoff Tracker – The layoff tracker is a monthly report by Challenger, Gray & Christmas, an executive outplacement and career transition firm, that compiles the number of job cuts announced by U.S.-based employers—a forward-looking indicator of labor market stress, published monthly since the 1990s. Employers announced 62,075 job cuts in July 2025, a 29% increase from June and a 140% rise year-over-year compared with July 2024. The trajectory has pushed total announced layoffs in 2025 past 800,000 positions, a level not seen since 2020.

Consumer spending – Personal Consumption Expenditures (PCE) rose 0.3% in June, while retail sales rose 0.6% in June, both reversing losses seen in the May data. This indicates that the consumer is still hanging in there despite weakness in the labor market.

Our view

As shown in the chart below, the past few months clearly show a weakening labor market. Looking more closely at the data, if not for the healthcare and social assistant categories, which created all of the jobs over the past couple of months, then the U.S. economy would have lost jobs each of the past three months.

We pointed out last month that there was a noticeable discrepancy between the private sector jobs report that showed material weakness and the BLS report, and now those revisions make more sense, bringing the two closer to alignment. Consumer spending data is holding up for now, but data is beginning to paint a picture of a consumer who is more stretched and less excited about spending. A sampling of recent comments on earnings calls from consumer-facing CEO’s provides interesting color on the consumer. “There’s a lot of consumer anxiety,” said Dirk Van de Put, chief executive of Mondelez International, which makes Oreo cookies, Ritz crackers, and Cadbury chocolate. Also, Andre Schulten, the CFO of Procter & Gamble, which makes common household items such as Tide, toilet paper, and shampoos, said, “We see consumption trends consistently decelerating,” and signs of slower spending across essential products as well.

On a positive note, the unemployment rate is still hovering just above 4%, which remains strong by historical standards; unless we see a noticeable increase in the unemployment rate, the consumer will likely hang in there. However, the jobs market is weakening, and the consumer appears more hesitant to spend as uncertainty regarding the economy and tariffs have created confusion and led to deteriorating consumer confidence.

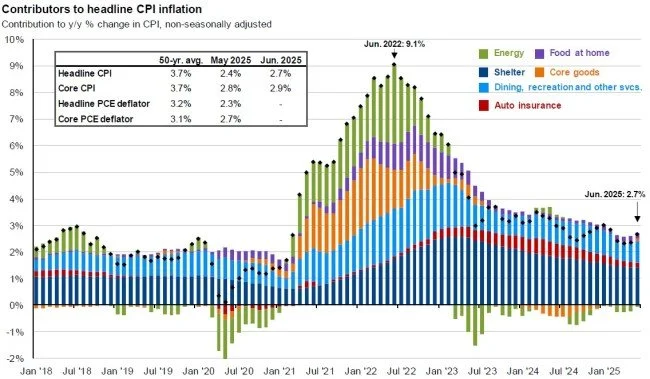

Inflation – The monthly report on consumer prices (CPI) for the month of June showed that prices accelerated more than anticipated, with the CPI increasing 2.7% from a year ago and 0.3% for the month. Core CPI, which excludes food and energy prices, increased 0.2% for the month and 2.9% from a year ago.

Our view – Consumer prices increased last month, driven largely by higher energy, food, and shelter costs. This was the third consecutive monthly increase and is likely reflecting the early effects of tariffs as well as housing-related inflation, which remains elevated. Inflation, while meaningfully lower than the 9% level we saw in 2022, remains above the Fed’s stated inflation target of 2%.

Interest Rates & The Federal Reserve - In its July 2025 meeting, the Federal Reserve held interest rates steady at 4.25–4.50%, emphasizing a cautious, data-driven approach amid rising uncertainty from the labor market, tariffs, and global tensions. Notably, two Governors, Michell Bowman and Christopher Waller, dissented, favoring a quarter-point rate cut, marking the first time since 1990 that two governors opposed the decision in the same meeting. The Fed still projects two rate cuts this year, though internal disagreement persists - some officials see no cuts. Inflation remains above target, and all future decisions will be heavily reliant upon upcoming data releases.

Our view – The Federal Reserve is in a real pickle……

The Fed is caught in a tough spot at the moment with growth expectations unclear, a softening labor market, and inflation signals reaccelerating. A couple of days after their last meeting, we received the latest BLS jobs report, which was materially weaker than anticipated. As a result, the market moved quickly, pricing in an over 80% chance of a rate cut at the next meeting in September and also increasing the projected number of rate cuts this year from two to three. It appears relatively clear at this point that the market and the Fed are in alignment that we will see a rate cut at the next meeting, particularly on the back of the latest jobs data.

Equity Market Update – As of this writing, U.S. equity markets have continued to rally and are at or near all-time highs, with the S&P 500 up 7.3% on the year. International markets continue to lead the charge, however, as the dollar has dropped materially in the first half of the year.

Our view – The equity markets are, for now, brushing off concerns around economic data and tariffs, and are more focused on earnings, tax policy, and the prospect for lower interest rates. On the earnings front, recent earnings reports have generally been good, thanks to beats from companies like Microsoft, Meta, Palantir, and others that are benefiting from a massive AI capex boom. Furthermore, with the new legislation out of Washington now cemented into law, the tax landscape is clear and provides companies with certainty on the tax front moving forward. Finally, stocks love lower interest rates and are beginning to anticipate the prospect of lower rates coming shortly. We will continue to update you as developments occur.

Enjoy the remainder of the summer, wherever that may take you!

As always, please let us know if you have any questions or concerns, or if we can provide assistance with any other financial planning matters including education, taxes, insurance, or estate needs.