Gill Capital Partners January 2023 Update

Welcome to 2023! We are sure most of you will echo our sentiment that, at least from an investing perspective, we are happy to have 2022 behind us. It’s early in the year, but thus far, 2023 has started off on a much better foot with markets rebounding rather significantly during January. We are seeing significant reversals in most markets, with many of the segments that were down the most last year leading the charge higher this year. We were thrilled to host a virtual “fireside chat” last week with Liz Ann Sonders, the Chief Investment Strategist at Charles Schwab. We will summarize the key points from our discussion with her, but first, the interesting factoid of the month:

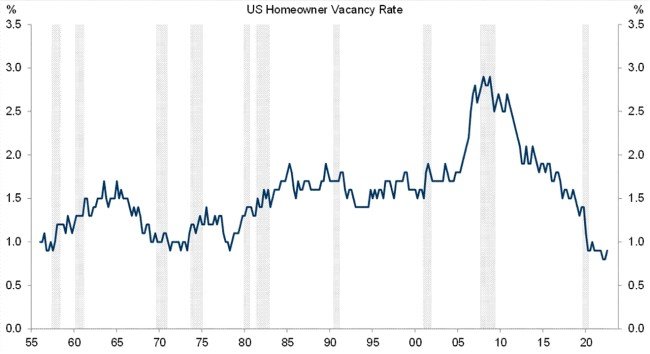

Worried about the housing market? While this market has slowed from its unsustainable pace, we do not believe the housing market will collapse like we saw in 2008. If anyone tells you that housing prices are going to collapse, show them the chart below. The homeowner vacancy rate made an all-time high just before the great financial crisis in 2008. Today it stands just off the all-time low; we continue to have a housing shortage in this country. This data, combined with the fact that the vast majority of homeowners have fixed rate mortgages locked in at or below 4%, tells us that the residential housing market is likely to remain tight. Certain parts of the commercial real estate market may be a completely different story, but that is a discussion for another time.

Gill Capital Partners Speaker Series – Liz Ann Sonders

We kicked off our 2023 Speaker Series with one of our favorite market strategists and speakers, Liz Ann Sonders. Liz Ann is the Senior Vice President and Chief Investment Strategist at Charles Schwab & Co. She is a frequent guest on CNBC and Bloomberg TV and is regularly quoted in the Wall Street Journal, Barron’s, and the New York Times. We appreciate her down to earth approach and unique insights into the economy and markets. If you missed the event, you can watch the replay here. Below are a few of the key takeaways from Liz Ann:

2023 is off to a good start - 2023 is off to a strong start. The areas of the market that were the weakest in 2022 (tech, international, and emerging markets) are leading the charge higher so far in 2023. We are not out of the woods yet, as bottoms are a process, not a moment.

Thoughts on recent GDP report that was better than anticipated – While the report was better than anticipated, the details of the report show a more somber picture. The detailed monthly data suggests a gloomy outlook for Q1, with the distinct possibility that we could see a negative GDP in Q1. We are only a month into the quarter and a lot can still happen, but the trends are pointing in that direction.

Recession talk – Liz Ann characterizes the current period, including Covid, as a series of “rolling recessions,” with Covid lockdowns driving an initial widespread recession for the entire economy. That proved to be short lived, as federal stimulus fueled a demand surge that quickly brought the economy out of recession. Demand was largely focused on goods, not services, as many service-based businesses were shut down due to the lockdowns. That became the breeding ground for the inflation problem that we are still dealing with now, which was further exacerbated by the supply chain issues. Fast forward to the current period and we are in recession for much of the goods side of the economy. However, we are not in a recession on the services side of the economy as pent-up demand is still driving strong consumer spending on services. If and when the services side enters a recession, the goods side may be in recovery. Liz Ann believes that the current environment is a bit more nuanced, with recessions popping up in parts of the economy as opposed to a binary recessionary environment like Covid or 2008.

Labor Market – The labor market has continued to show strength, largely due to the service economy, which employs far more people than the goods side of the economy. Additionally, the demographic backdrop is driving a budding labor shortage globally. As a result, there is a greater tendency, as compared to past slowdowns, to hang on to labor. However, there are meaningful cracks beginning to form. The unemployment rate is the most lagging of all economic indicators as recessions drive rising unemployment, not the other way around. Layoff announcements have accelerated, as companies look to right size their cost structure. While Liz Ann believes that the unemployment picture will ultimately get worse before it gets better, she does not see unemployment reaching 2008 or Covid levels.

Inflation – The housing component of inflation has been the stickiest input, and this is largely due to a rent calculation that does not accurately capture real-time rental data. Real-time indicators that track rents have all rolled over and are beginning to indicate disinflation, but that data hasn’t shown up yet in the government calculation. It is coming, and it will bring down the overall inflation numbers. It is also important to understand that inflation is a rate of change. Decelerating inflation does not mean that prices are coming down, it just means that they aren’t going up as quickly. Prices of many things may not experience “deflation” to pre-pandemic levels, but increases are sure to stop rising at such a dramatic pace. The 25 years leading up to the pandemic saw low inflation driven by cheap goods, cheap energy and cheap labor. Unfortunately, the backdrop has changed for all three and paints a very different picture around the prices of goods and services going forward.

Federal Reserve –We now see a significant disconnect between the Fed’s projected path for rates and the market’s path for rates. The Fed has indicated that rates will remain at the terminal rate for some time, while the bond market is projecting 1-2 rate cuts later this year. The Fed will only cut rates if economic conditions deteriorate enough to warrant them doing so. The market has rallied recently in anticipation of the Fed pausing their rate hikes.

Stock Market – The recent rally looks better from a bottoming perspective as opposed to past rallies in 2022. Liz Ann anticipates earnings to continue to deteriorate further, along with the labor market. However, from a technical and sentiment perspective, she is seeing some of the signs that occur during the bottoming process for markets.

Thoughts on the Declining Dollar – While it is too early to say that a new trend is in place, the dollar has declined precipitously following a meteoric rise through most of last year. This has benefited international equity investments, which are some of the best performing asset classes over recent months.

2022 Year-In-Review & Looking Forward with Perspective

2022 was an unpleasant one for stock and bond investors alike. Below are the annual returns for each major asset class in 2022:

Stocks: -18.0%

Bonds: -13.0%

Cash: +4.4%

Cash beat stocks and bonds for the first time since 2018 and bonds had their worst year since 1931. While negative years are rare for bonds, they are not all that rare for stocks. In the past 95 years, stocks have been positive 69 of those years, or 73% of the time, and negative 27% of the time. While anything can happen in the short-term, investors of stocks have been rewarded over the long term. Below are the annual returns for each major asset class from 1928-2022:

Stocks: +9.6%

Bonds: +4.6%

Cash: +3.3%

Volatility is a necessary evil with stock investing in order to earn long term positive returns. We like to reference the chart below, which represents the range of volatility and the dramatic narrowing of outcomes as you go further out in time. While there is significant volatility in the range of returns inside of 5 years, that risk is dramatically reduced with a longer perspective.

While 2023 is off to a great start so far, it is still early, and we do not know what the rest of 2023 will bring. Back-to-back down years, while not out of the question, are not common historically. We will continue to provide updates as we progress throughout the year.

As always, please let us know if you have any questions or concerns, or if we can provide assistance with any other financial planning matters including education, taxes, insurance or estate needs.