Gill Capital Partners 2022 Year-End Update

First and foremost, all of us at Gill Capital Partners would like to say Happy Holidays to our friends, clients, and partners, and we wish you all a peaceful and healthy new year. The team at Gill Capital Partners is incredibly thankful for all of you. We feel fortunate for the relationships we have with all of you.

From a market perspective, 2023 cannot come quickly enough. 2022 has been a difficult year for most investments, as the Federal Reserve continues to painfully wean this economy from years of extremely low interest rates in response to the worst inflation problem in 40+ years. We look to 2023 with anticipation and hope for a kinder Federal Reserve. Before the calendar flips over, we wanted to provide updates on the most recent Federal Reserve news, and updates to our portfolio strategy as we move into next year. We will touch on each of these below, and of course provide our view, but first, the interesting factoid of the month:

Obviously 2022 was a bad year for stocks, but it was also a bad year for bonds. In fact, 2022 has so far been the worst year on record for the bond market since 1931, when bonds were down -15.68%. Interestingly enough, 1932 proved to be one of the best years on record for bonds, with returns of nearly 25%. Could another huge year be in store for bonds?

Inflation, Interest Rates and the Federal Reserve

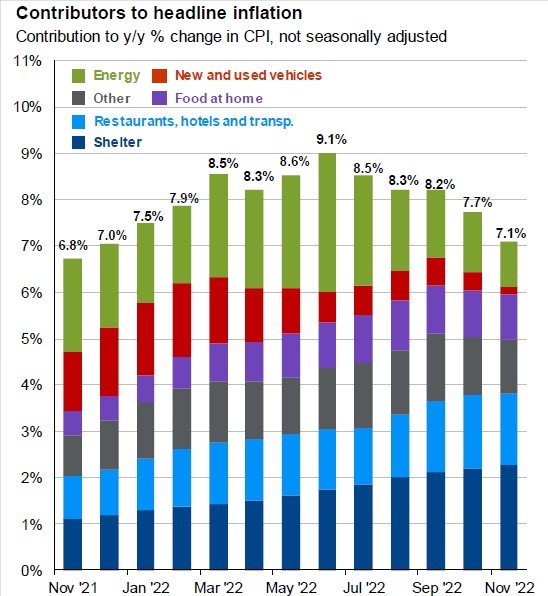

Inflation continues to decelerate meaningfully, as shown below in the chart of year-over-year changes in CPI. November’s report of a 7.1% year-over-year increase continued that downward trend, but the Federal Reserve is not yet satisfied.

The Federal Reserve now sees it’s terminal rate at slightly above 5% (currently the target range is 4.25% to 4.5%). Federal Reserve Chairman Jerome Powell recently said “the data that we received so far for October and November clearly show a welcome reduction in the month of price increases. It will take substantially more evidence to give confidence that inflation is on a sustained downward path.” Translation: we need to see inflation come down more before we are done raising rates. The continued focus on inflation and higher rates was an unwelcomed development for markets and Fed watchers who were hoping to see the Federal Reserve lighten their rhetoric following multiple months of better-than-anticipated inflation reports. Stocks moved lower following the remarks from the Federal Reserve as hopes for lower rates were dashed, at least for now. The bond market is not buying the tough talk from the Fed, however. The 6-month Treasury is currently the highest point on the Treasury curve at 4.52%, roughly 60 basis points below the Federal Reserve terminal rate forecast of 5.1%. This tells us the bond market does not believe rates will increase as much as the Fed is telling us.

Our view – The Fed is talking tough and is clearly focused on bringing inflation under control. They want to see inflation closer to 2%. Inflation is coming down, and dramatically so in certain areas. It is the sticky shelter and food components that are the last bastion of inflation. In fact, if you were to remove the shelter component from the calculation, CPI would have been negative for the past couple of months. The good news is we are seeing visible slowing in food and shelter inputs over the past couple of months. Other areas, like energy and used cars, are seeing meaningful price drops. Used cars prices are falling at a 36% annualized rate. To put the current trend in perspective, if the downward trend in inflation continues, we will be looking at 2% CPI numbers by June. Inflationary pressures are easing along with growth throughout the economic landscape. The bond market knows this and is signaling doubt around the Federal Reserve’s current forecast because of it. This is spurring some investors to lock in yields that might look extremely attractive in the future. For stocks, there is a lot of bad news already priced in, especially with regard to growth stocks. From a valuation perspective, the S&P 500 is slightly below its long-term average on a P/E basis. We would not classify stocks as expensive or cheap, but they might just be a coiled spring ready to bounce if the bond market is right. The Santa Claus rally that everyone hoped for this year has been replaced with tax selling, which should subside as we get into 2023, and fund repositioning should lead to value buyers coming back into the market. While we are cautiously optimistic about stocks moving forward, our near-term convictions lie in the bond market. More on this below.

Portfolio/Strategy Update

Coming into this year we were significantly under-weight core fixed income due to the extreme low interest rate environment. Furthermore, within our core fixed income allocations we maintained a focus on short durations (a good decision). Rates have increased materially, and we believe we are approaching a peak in rates. As such we are meaningfully increasing our allocations to core fixed income and extending maturities to lock in these higher yields for years to come. We are excited about the opportunity in fixed income, as we haven’t seen yields like this in many years. These changes will happen in portfolios over time, and we will look for opportunities to extend duration through repositioning current holdings, using cash from maturing securities, and allocating new cash.

We hope everyone has an excellent New Year’s holiday and we look forward to seeing you in 2023!

As always, please let us know if you have any questions or concerns, or if we can provide assistance with any other financial planning matters including education, taxes, insurance or estate needs.