The Daily Difference: Pre-Presidential Election Update

Pre-Presidential Election Update With the election almost upon us, we wanted to send out a few words about post-election market behavior. As we have said before, we are not making any significant portfolio adjustments ahead of the election, as trading on incomplete information is generally a fool’s errand. We prefer to take the long view, understanding that there will be volatility, but that proper asset allocation, diversification, and discipline are how investors achieve long term goals. Below are excerpts from an article published this morning, courtesy of Oliver Renick at Bloomberg, that we believe is helpful in outlining how volatility surrounding past elections has impacted longer term returns.

Don’t Worry When the Stock Market Goes Crazy after Election, By Oliver Renick

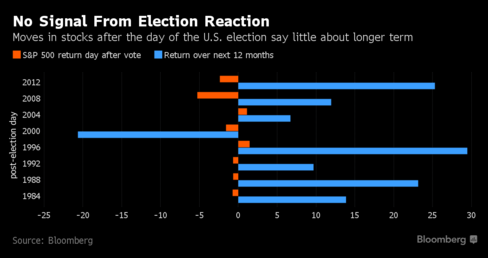

In the hours after the president is elected, equity investors need to brace for volatility. What they shouldn’t do is panic. That’s because regardless of how prices react on Nov. 9, next-day moves in the S&P 500 Index are useless in telling what comes after. While the index swings an average 1.5 percent the day after the vote, gains or losses over the first 24 hours predict the market’s direction 12 months later less than half the time. This matters because the compulsion to act in the vote’s aftermath is often very strong -- stocks swing twice as violently as normal those days, data compiled by Bloomberg show. They plummeted 5 percent just after Barack Obama beat John McCain in 2008. But while nothing says Wednesday’s reaction won’t be a harbinger for the year, nothing says it will, either, and investors should think before doing anything rash.

“Trying to trade that is very difficult,” said Thomas Melcher, the Philadelphia-based chief investment officer at PNC Asset Management Group. “Even if the market sells off, if you have any reasonable time horizon that should be a buying opportunity. The dust will settle and people will conclude the economy is OK.” In the 22 elections going back to 1928, the S&P 500 has fallen 15 times the day after polls close, for an average loss of 1.8 percent. Stocks reversed course and moved higher over the next 12 months in nine of those instances, according to data compiled by Bloomberg.

Nothing shows the unreliability of first-day signals more than the routs that accompanied victories by Obama, whose election in the midst of the 2008 financial crisis preceded a two-day plunge in which more than $2 trillion of global share value was erased. It wasn’t much better in 2012, when Election Day was followed by a two-day drop that swelled to 3.6 percent in the S&P 500, at the time the worst drop in a year. Of course, Obama has been anything but bad for equities -- or at least, he hasn’t gotten in their way. The S&P 500 has posted an average annual gain of 13.3 percent since Nov. 4, 2008, better than nine of the previous 12 administrations. Data like that imply investors struggle to process the meaning of a new president just after Election Day, or infuse the winner with greater influence than they have. “Some people are probably going to overreact, and there will be other investors trying to second-guess what those investors are doing,” said David Brown, a professor of finance at the University Of Wisconsin School Of Business, in Madison, Wisconsin. “There is a salience of short-term events, particularly bad events that lead people to react to short-term information.”

We’ll follow up with additional communication after the election. If you have questions, please don’t hesitate to contact us.