PulsePoints > October Investments & Market Update

Gill Capital Partners Q3 2016 Commentary

“We don’t have to be smarter than the rest, we have to be more disciplined than the rest.” – Warren Buffett

Q3 2016 Market Overview

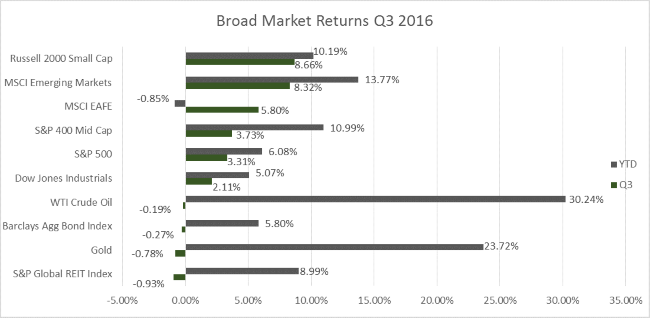

The third quarter proved to be a good quarter for most equity indices, with emerging market, international and small cap equities leading the charge. As shown in the chart below, most equity indices are now positive for the year. The Dow Jones Industrials and the S&P 500 are up 5% and 6%, respectively, through the end of the third quarter. Bonds were relatively flat for the quarter, as interest rates ended the quarter at roughly the same historically low levels at which they started. The yield on the 10-year Treasury continues to hover around 1.6%. Commodities, while volatile during the third quarter, were mostly unchanged and are still up significantly year-to-date.

As we look ahead into the fourth quarter, investors will turn their focus to the election and the Federal Reserve meeting in December, both of which have the potential to create volatility in the markets. However, given generally strong fundamentals, we anticipate this volatility to be transitory, barring a significant surprise in the election cycle or from other geo-political sources.

What worked in Q3?

- International equities, particularly emerging market equities, had a strong quarter. Emerging market equities have underperformed in recent years but have rallied almost 14% year to date. The strong commodity market, along with diminished concern about negative fallout from the Brexit vote, contributed to the strength.

- Small-cap equities led U.S. equities for the quarter, outperforming their large-cap counterparts. Small caps did not participate as fully in the rally off of the February 11th market lows, but more than made up for it during the third quarter.

- Many of our active managers, which have struggled to beat their benchmarks for much of 2016, saw significant outperformance in third quarter. Just as we see cycles in asset classes, we have recently experienced similar cycles between passive and active management. We believe this provides great confirmation for our paired approach of active and passive management in our portfolios.

What didn’t work in Q3?

- While still one of the best performing asset classes year-to-date and over the past several years, REITs saw modestly negative returns in the third quarter, as valuations and the specter of higher rates negatively impacted REITs.

- After a very strong start to the year, value stocks underperformed growth stocks for the quarter. Growth had trailed for the year and made up substantial ground on value during the third quarter.

What are we talking about at Gill Capital Partners?

Our Investment Committee continues to meet to review portfolio allocations, macro-economic events and managers. Below are a few items that are top of mind as we move into the fourth quarter.

Election – The coming weeks will certainly be interesting, and for many of us the election cannot come soon enough. We get a lot of questions about how this election might impact the markets, and specifically how a Clinton or Trump presidency might influence markets.

Our View – While recent general election polling shows a relatively tight race with Secretary Clinton establishing a modest lead, the actual election probabilities forecasting, which takes into account state by state electoral college probabilities, show Secretary Clinton building a fairly substantial lead (most forecasts show the probability of a Clinton win between 70% and 80%). We believe that the markets would experience elevated volatility with a Trump presidency, at least in the short term, while a Clinton election would largely represent status-quo and policy clarity towards which the markets will react favorably. As of this writing, we believe that the markets are discounting the current probability forecasts that show Clinton in the lead and generally reacting favorably to them. We also recognize the potential for the “silent majority” to impact this election, and that a lot can happen between now and Election Day. We are not making modifications to portfolios in anticipation of any particular election result, but will continue to watch the race closely and will look at doing so if we deem it necessary. Historically, the winning political party has had little to no long term impact on the financial markets.

Federal Reserve & Interest Rates – The Federal Reserve held rates steady in September and guided their long term forecast for interest rates lower once again. They are, however, attempting to set market expectations for a rate increase at the December meeting. When will the Federal Reserve raise interest rates?

Our View – Barring significant market or geo-political turmoil between now and then, it seems likely that the Federal Reserve will raise interest rates by 0.25% in December. Bond markets are already anticipating this rate increase, followed by a continued slow and methodical approach to further increases. We continue to believe the Fed will be systematic in their actions, and that this will likely lead to continued low interest rates and a supportive environment for equities and bonds.

Please let us know if you have any questions or concerns about this report, or if there have been any changes in your financial circumstances including education, taxes, insurance or estate needs.