Gill Capital Partners November 2023 Market Update

We sincerely hope that all of our clients, friends, and their families are safe, and we continue to wish for peace and an end to the horrible situation in the Middle East. Moving on to the world of finance and economics, we have plenty of new and interesting developments to discuss, including a Federal Reserve meeting, an update on interest rates, a look at Q3 GDP (and it was a whopper!), and a Q3 earnings update. We will get into all of that and, of course, provide our views, but first, the interesting story of the month: WeWork, and its incredible fall from grace.

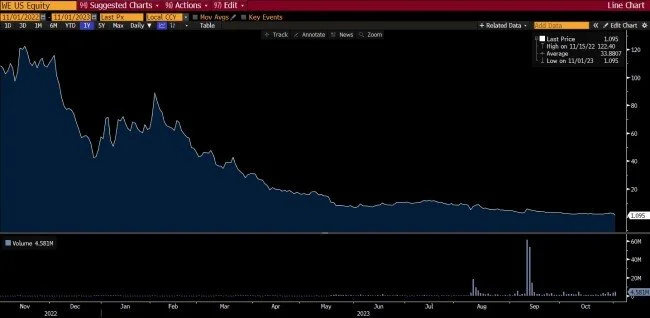

WeWork, the flexible office-space provider and venture-backed star, which once carried an astronomical valuation of $47 billion, is now preparing to file for bankruptcy as early as next week. As shown in the chart below, the stock has collapsed over the past two years as the company has continued to burn through cash, and is now valued at just over $50 million and trading at roughly $1 per share. The firm, which once held the lofty title of the largest tenant in many major markets across the country including New York, San Francisco, Washington D.C., and Denver, has 777 locations across 39 countries. WeWork has an estimated $10 billion in lease obligations on the books. While the flexible work model continues to be popular, WeWork dramatically overpaid for prime locations as part of its aggressive growth campaign, and the model of paying for expensive long-term leases while signing short term tenant leases has proven challenging.

Federal Reserve Leaves Rates Unchanged

With much anticipation, The Federal Reserve Open Market Committee (FOMC) met on Wednesday and voted unanimously to leave rates unchanged at their current 22-year high. At the previous meeting in September, most Federal Reserve officials projected one more rate increase, but markets were skeptical that would happen leading up to this meeting. Fed officials have now skipped a rate hike for two consecutive meetings, following the fastest pace of rate increases in four decades. In his comments on Wednesday, Fed Chair Jerome Powell suggested that he expects that the rate increase, combined with the process of shrinking the Federal Reserve’s balance sheet, is already slowing the economy and will continue to do so. Asked about the potential for future rate hikes, and if the current level of interest rates is sufficient to bring inflation down, Powell said, “The process of getting inflation sustainably down to 2% has a long way to go” and that “risks around the Fed doing too much or too little to fight inflation have become more balanced.” Stocks climbed and bond yields dropped following the announcement, as markets see a high likelihood that the Federal Reserve is now finished raising rates.

Our view – We tend to agree with the market’s interpretation that, barring some sort of inflationary surprise, the Federal Reserve is done raising rates. That is good news! Long-term interest rates have risen dramatically in the past 3 months in anticipation of a “higher for longer” environment and are now very much in-line with Federal Reserve forecasts. We anticipate that inflation will continue its downward trend, as economic activity will cool and the impact of higher interest rates will continue to trickle through the economy. Somewhat surprisingly, the economy is still on very strong footing, with unemployment at just under 4% and third quarter GDP growth coming in at +4.9%, the strongest pace of growth since the fourth quarter of 2021 (more on that below). The Federal Reserve has left the door open to additional hikes, but, at this point, we do not see that as the likely path. Markets are now looking forward to interest rate stabilization and potentially lower rates. With stocks having pulled back over the last quarter, and bonds looking like the best value in 25 years, we are feeling more optimistic about forward-looking returns from diversified portfolios.

Third Quarter GDP – Where Did That Come From?

Third quarter GDP came in much hotter than expectations, showing that the economy grew at a 4.9% annual pace in the third quarter, compared to the 4.5% that was anticipated. As reflected in the chart below, this was the fastest pace of economic growth since the fourth quarter of 2021.

Our view – Wow! This seemed to catch everybody by surprise and showed the resilience of the U.S. economy to higher interest rates. The increase was largely driven by consumer spending, as U.S. consumers went on a spending spree in the final months of the summer. While Q3 GDP was impressive, most economists anticipate growth to slow considerably in the coming months, as they do not believe consumers can continue to spend at the same rate. That said, most economists still think the U.S. economy can skirt a full-blown recession. The strength of the U.S. economy in the face of dramatically higher interest has been surprising and provides some level of optimism for a “soft landing.”

Market Update

We will be brief; November is now here and that is good news! The S&P has gained 9 out of 10 times in November over the last 10 years and is already off to a good start. For stocks to move higher, we need rates to stabilize (or fall) and strong earnings reports to continue. Rates seem to have peaked, and markets like that. On the earnings front, 392 out of the 500 companies in the S&P 500 have reported Q3 earnings and, in aggregate, we have seen a slight beat on both revenue and profits. Companies have continued to temper forward-looking expectations but, in general, Q3 earnings have been solid. We received another look at the employment picture this week as well; hiring slowed as anticipated, and the unemployment rate ticked up slightly but remains below 4%. A softening labor market will provide more cover for the Federal Reserve to be done raising rates. Unfortunately, a lot of uncertainty remains on the geopolitical front. We hope for quick and peaceful resolution in regions of unrest, not just for the positive impact that will have on markets, but also for humanitarian reasons.

The third quarter brought negative returns in stocks and bonds; however, we are optimistic about forward-looking returns, particularly in fixed income, where we can now generate safe income at levels last seen 25 years ago.

Stay tuned, and, as always, please let us know if you have any questions or concerns, or if we can provide assistance with any other financial planning matters including education, taxes, insurance or estate needs.