Pulse Points > November Investments & Market Update

Gill Capital Partners November 2017 Market Commentary

Tax Reform Overview & Update

House Republicans released a bill last week proposing significant changes to the tax code. Now, details are beginning to emerge regarding the Senate Republicans’ version. Below is a brief overview of the proposed tax cut plans. Please remember that the proposed changes are far from becoming law. We expect significant changes to this proposal (and likely some heated confrontations) as this bill is reviewed and debated in the narrowly divided senate.

Fewer Tax Brackets

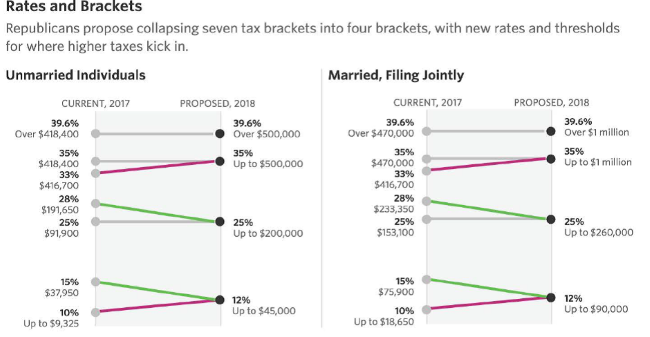

The House bill would reduce the number of marginal income tax brackets from seven to four. Below is a brief summary of the changes (also shown in the chart below):

- The top rate of 39.6% would stay the same, except the income level at which it would apply would increase from $470,000 to $1 million for married couples.

- Couples filing jointly with a household income between $233,350 & $470,000 would be taxed at 35%. Currently, the bottom half of that bracket pays a lower rate of 28%.

- Couples filing jointly with a household income between $75,900 & $233,350 would be taxed at 25%. Currently, the top of this bracket pays a higher rate of 28%.

- Couples filing jointly with a household income up to $75,900 would be taxed at 12%. Currently, those earners fall into the existing 10% and 15% brackets.

The Senate bill would maintain seven individual brackets, but they vary slightly from the current brackets (10%, 12%, 22.5%, 25%, 32.5%, 35% & 38.5%). It is not yet clear what the income thresholds are for each bracket.

Deductions & Credits

- Under the proposed House bill, popular tax incentives would be eliminated, including deductions for medical expenses, student loan interest, adoption expenses, and more. The Senate bill maintains the adoption credit and the medical expense deduction.

- The House bill removes the state and local tax deduction and adds a local property tax deduction in its place with a $10,000 cap. The Senate bill removes the state and local tax deduction entirely.

- The House bill caps interest deductions for mortgages at $500,000 for new purchases, down from $1 million currently, while the Senate bill maintains the $1 million cap.

- The House bill increases the child tax credit from $1,000 to $1,600 and adds $300 for each parent, while the Senate bill expands the child tax credit to $1,650, but phases it out at income levels above $500,000.

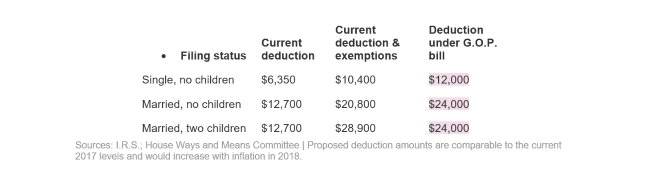

- Both the House and Senate bills increase the standard deduction from $6,350 to $12,000 for individuals and from $12,700 to $24,000 for couples. The table below shows the impact this change would have on various filers.

Lower Corporate Rates & Creation of a New “Pass Through” Income Rate

- The House bill would lower the corporate tax rate to 20% from 35%, while eliminating most deductions and credits. The Senate bill would also lower the corporate tax rate to 20%, but under their bill, this component of the tax plan would be delayed by one year to January 2019.

- The House bill sets forth a new corporate tax rate of 25% for “pass through” income. Pass through income is income generated through businesses structured as LLC’s, proprietorships, partnerships, etc., that currently pay taxes at the income rates of the owners. Pass through businesses account for roughly 95% of the businesses in the country and the majority of corporate tax revenue. A portion of qualified pass-through income would qualify to be taxed at the new corporate tax rate of 25%. The Senate bill will also tax a portion of pass through income at corporate rates, but the details have not been released.

Alternative Minimum Tax (AMT)

Both the House Republican bill and the Senate bill would eliminate the AMT.

Changes to Retirement Savings Incentives

There were rumors prior to the bill’s release that the cap on 401k contributions would be reduced. However, no such amendment is in either bill.

Estate Taxes

The House bill would see the current tax exemption on estates doubled to $11.2 million for individuals and $22.4 million for couples. The House bill eliminates the estate tax completely by 2024. The Senate bill also doubles the estate tax exclusion, but does not do away with it in 2024.

Our View:

Again, it is important to keep in mind that these proposed changes are far from a done deal. Details are still emerging from the Senate, and there will likely be significant modifications based upon constituent needs, public opinion, and assessment. This bill faces substantial headwinds in the Senate as the Republican majority is razor thin and fractured. Furthermore, according to the Joint Committee on Taxation, the House bill is estimated to increase the federal deficit by nearly $1.5 trillion over ten years, a statistic that will give Senate Republicans no cover with their conservative base. That being said Republicans badly needed a victory this year or risk going into 2018 without any significant legislative wins.

Our initial assessment of the proposed bill tells us that corporations, pass-through income tax payers, and recipients of large estates are clear winners. Potential losers include upper middle class individuals who could see their marginal rates increase, taxpayers who currently claim specific deductions that will be eliminated, and trust and estate attorneys, who might be looking for a new profession given the proposed changes to the estate tax law.

Gill Capital Partners Client Survey

We recently completed our client survey and we want to thank all those who participated. The goal of the survey was to gain a better understanding of our clients’ needs and interests and to ensure that the service that we provide meets or exceeds expectations. We are pleased and honored that our clients gave us an overall rating of 4.8 out of a possible 5 points. We work very hard to deliver an amazing client experience and these results are extremely gratifying.

As always, please let us know if you have any question or concerns, or if we can provide assistance with any other financial planning matters including education, taxes, insurance or estate needs.