Pulse Points > August Investments & Market Update

Gill Capital Partners August 2017 Market Commentary

What are we talking about at Gill Capital Partners?

Our Investment Committee meets weekly to review portfolio allocations, macro-economic events and our investment managers. Below are topics that are top of mind within the committee. This month we are taking a break from our usual economic and market commentary to provide our perspective on one of the many inputs of portfolio construction – specifically, active versus passive investing.

Active vs. Passive Investment Management in 2017 – Who Is Winning?

The debate surrounding active versus passive investing draws competitive philosophical and dogmatic views from seasoned investment professionals and newcomers alike. Members of both camps are quick to argue the merits of their position. In the following paragraphs, we’ll summarize the arguments and share our thoughts on the topic.

Active Investing – As the name implies, active investment management takes a hands-on approach and involves an individual or team of individuals actively evaluating and selecting investments for a portfolio, mutual fund, or hedge fund. The goal of active management is to beat the benchmark’s risk-adjusted returns. Proponents of active management point to the ability of quality managers to beat their benchmark over a stated time period. Their ability to do so relies on their investment process; that is, how they apply quality standards and perform fundamental analysis. If they have a solid investment process, in theory, they will be buying higher quality businesses and achieving higher performance than the benchmark over a long period of time. Furthermore, they generally have the ability to actively manage risk by rotating to different sectors, industries or companies based upon macroeconomic events. Skeptics, however, will point to the fact that the vast majority of active managers are not able to outperform their benchmark on a regular basis, and that most active managers have higher fees as compared to passive investment vehicles.

Passive Investing - The goal of passive investing is simply to match the returns of a specific benchmark or benchmarks as cost-effectively as possible. This is usually done through exchange traded funds (ETFs) or index mutual funds. Proponents of passive investing are quick to point out that most active managers fail to beat their benchmarks on a consistent basis, and therefore investors are better off in an investment vehicle that will deliver market returns in a cost-efficient manner.

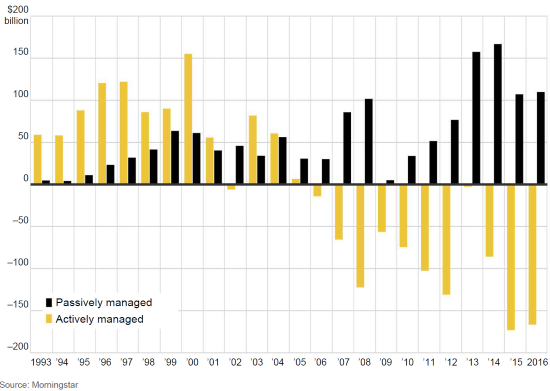

Active management still dominates the investment landscape, with almost two-thirds of all assets in the U.S. in actively managed portfolios. This is down from approximately 80% a decade ago, as passive investing has gained momentum. Over the past decade, money has poured into low-cost passive investment strategies like ETFs and index funds as depicted in the chart below.

Actively Departing

Net Flows of U.S. stock mutual and exchange-traded funds (Billions)

Our View:

What is the right strategy for you? At Gill Capital Partners we believe the best approach is an intelligent combination of active and passive strategies. We believe in placing specific allocations with select active managers in asset classes where we believe active management can add value, or where we have high conviction in a specific manager. We then combine this with positions in low cost passive managers using ETFs. We believe this approach allows investors to benefit from the advantages of both. For several years leading up to 2017, active managers struggled to outperform their passive counterparts. In 2017, however, we are seeing significant outperformance from most active managers on our platform.

Manager Highlight – Salient MLP & Energy Infrastructure Fund:

This month, we’ve chosen to highlight the Salient MLP & Energy Infrastructure Fund, which we added to some client portfolios earlier this year. Salient seeks to maximize total return by investing in securities of MLPs and energy infrastructure companies.

An MLP, or master limited partnership, is a limited partnership that is publicly traded on an exchange. An MLP combines the liquidity of a public security with many of the tax advantages of a limited partnership. Many MLP’s focus on oil and gas pipelines and make money by transporting volume through their pipes, not dissimilar to a toll road. They do have a high level of correlation to the headline price of oil and gas even though they are not commodity producers.

This fund offers access to an expansive universe of MLPs and MLP-related companies, providing the potential to capture a broad range of energy infrastructure opportunities. The fund is managed by a team of seasoned MLP and energy veterans in Houston. The team starts with disciplined bottoms-up research focused on stability of distributions, estimated distribution growth and current valuations relative to intrinsic value. We chose Salient following an exhaustive search in the space. We view this as a good long-term entry point into an asset class that has favorable risk/reward potential, high current yield, attractive valuations, and potential tailwinds from the Trump administration’s focus on energy and infrastructure. This is a perfect example of an investment where we believe an active manager is important. Given low energy prices, many of the companies in this space have struggled recently, which is why we feel it’s important to have a solid manager performing fundamental analysis to identify only the highest quality companies.

As always, please let us know if you have any question or concerns, or if we can provide assistance with any other financial planning matters including education, taxes, insurance or estate needs.